FBR Sets Deadline for Income Return Filing for Tax Year 2023 – What You Need to Know

FBR Sets Deadline for Income Return Filing for Tax Year 2023 What You Need to Know

Introduction:

As the tax year comes to a close, the Federal Board of Revenue (FBR) in [Your Country] has set a crucial deadline for income tax return filing for the year 2023. For taxpayers, this annual ritual can be both intimidating and confusing. However, complying with the FBR’s guidelines and submitting your income tax return before the deadline is essential to avoid penalties and ensure a smooth financial journey. In this blog, we will explore the significance of income tax return filing, the implications of missing the deadline, and some useful tips to make the process hassle-free.

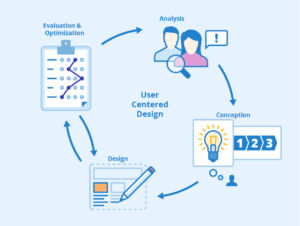

Comprehending the Process of Income Tax Return Filing.

Income tax return filing is a mandatory obligation for individuals and businesses with taxable income. It serves as a crucial mechanism for the government to collect revenue to fund public services, infrastructure, and other essential programs. The income tax return is a comprehensive document that outlines your income from various sources, deductions, and tax liability for the tax year.

FBR’s Deadline for Tax Year 2023:

The FBR has officially set the deadline for income tax return filing for tax year 2023 as [deadline date]. It is imperative for all eligible taxpayers to file their returns before this date to avoid penalties and legal consequences. The deadline is typically several months after the end of the tax year, providing taxpayers with sufficient time to gather the necessary documents and complete the filing process accurately.

Implications of Missing the Deadline:

Failing to meet the income tax return filing deadline can lead to several unfavorable consequences for taxpayers. Some of the key implications include:

Penalties and Interest: The FBR may impose penalties and interest on the outstanding tax amount for late filers. These additional charges can significantly increase the overall tax liability.

Legal Actions: Repeated failure to file income tax returns within the stipulated deadline may lead to legal actions and audits by the tax authorities.

Loss of Benefits: Timely filing of income tax returns is often a prerequisite for availing certain benefits and exemptions provided by the government.

Negative Credit Rating: Late or non-filing of income tax returns can negatively impact your credit rating and financial reputation.

Useful Tips for Hassle-free Income Tax Return Filing:

Organize Your Financial Records: Start by gathering all relevant financial documents, including income statements, expense records, investment details, and deduction proofs. Keeping your financial records organized will streamline the filing process.

Seek Professional Assistance: If you find income tax return filing overwhelming, consider seeking help from a qualified tax consultant or accountant. They can guide you through the process, ensuring accuracy and compliance.

Utilize Online Filing Platforms: Most tax authorities, including the FBR, provide online filing options. Online platforms are user-friendly, secure, and often come with built-in calculators to help you determine your tax liability accurately.

Double-check for Errors: Before submitting your tax return, review all the information provided to avoid errors or omissions that could lead to discrepancies in your tax liability.

Don’t Wait Until the Last Moment: Procrastination can be costly when it comes to income tax return filing. Start early, so you have ample time to prepare and file your return without feeling rushed.

Conclusion:

Filing income tax returns is not just a legal obligation but also a civic responsibility. By meeting the FBR’s deadline for tax year 2023, you contribute to the nation’s development and ensure a smooth financial journey. Avoid the consequences of late filing by organizing your financial records, seeking professional assistance if needed, and utilizing online filing platforms. Remember, timely and accurate income tax return filing is the key to a hassle-free tax season and financial peace of mind.

For More Related Articles Browse Our Website Blogster.pk

For social Connection You can also Visit and follow our Social media Platforms

Facebook , Instagram, Linkedin, Pinterest, Quora, Twitter, Youtube.